Most of us tend towards borrowing a loan when we’re cash strapped, and we do not have an emergency fund to rely on during such times. Even after careful budgeting and financial planning, we face monetary crunches that strain us immediately. Payday loans are one of the most innovative but controversial products in the consumer credit market. The lenders who offer these loans charge high-interest rate as they take a lot of risks. These loans are unsecured and short-term. That means you do not have to provide any collateral at the time of borrowing. If you’re considering to use a 12 Month Loan, then you must contemplate on a few tips for borrowing a loan responsibly.

Tip 1

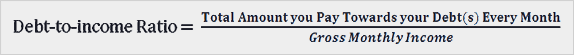

Calculate Debt-to-income Ratio

Debt-to-income ratio means the fraction of amount that you get when you divide the total amount you pay towards your debt every month by your gross monthly income.

It will give you a clear idea of how much do you earn each month and how much money you spend on the repayments. So, that it will be easier for you to prepare and stick to a budget.

Tip 2

Use a Loan Calculator

You will find plenty of loan calculators on the internet, which are free to use. Using them will help you estimate how much you need to pay monthly or weekly. Knowing the repayment amount beforehand will help you to evaluate your affordability.

Money Advice Service offers free loan calculator that allows you to determine how much a loan will cost you or how fast you can pay off your existing loans.

If you have any other debts, it will help you in knowing by when or how fast you can pay it off. That means you can prioritise your debts and repay them conveniently.

Tip 3

Pay on Time

If you keep on repaying the loan on time and in full, your credit score will improve. Moreover, always remember that every financial activity is taken into consideration by the Credit Reference Agencies for updating our reports timely. These are independent organisations that register your financial behaviour to help the lenders, and you understand your position

There are three major Credit Reference Agencies (CRA) in the UK – Equifax, Experian, and TransUnion (Formerly CallCredit). They record personal information and details about the financial history of every individual

with finances. The onus is on you to repay the loan. Therefore, prepare a repayment strategy before you borrow a loan. Every time you make a payment on time and in full, it boosts your score. A good credit score is considered a healthy sign of your financial fitness.

Tip 4

Be Honest

When you fill the online application form for a loan, provide correct information. You may get into unnecessary trouble if your details are not true. The lenders can easily verify the data that you’ve rendered to make their decision. Your loan application may be rejected by the lenders if they find the furnished details to be untrue.

Transparency plays an important role in developing your relationship with the lender. These are unsecured loans and the lender is taking a lot of risks by giving you the money that you need.

Lenders want to deal with borrowers who are transparent and reliable. There is no requirement of any collateral, and also, the lender doesn’t even ask you to arrange a guarantor. Therefore, as a responsible borrower, you must be transparent about your needs and affordability with the lender.

Conclusion

Whether you are planning to borrow a 12 Month Payday Loan or any other short-term or personal loan – be a responsible borrower. Building a strong relationship with the lender may prove to be beneficial for you in the future. The lender will be more than happy to lend you money the next time when you are in need if you keep up with the repayments. Never borrow an amount that you cannot afford to repay as this may create financial chaos in your life. Lack of money may disturb your peace of mind. However, you must remain strong to deal with the situation in the right manner to avoid further inconvenience.

To apply for a 12 month loan with us, Click Here.