Do you ever feel like your credit score is totally beyond your command or the current economic mess and mortgage is causing an overall decline in your credit scores? Think again, it might be time to adjust your thinking. A low credit score or not, your credit score can hit you on many new fronts.

Many people do not know about the credit scoring operation until they attempt to buy a home, take out a credit to start a business, or pay for a huge expense.

DEFINITION: CREDIT SCORE

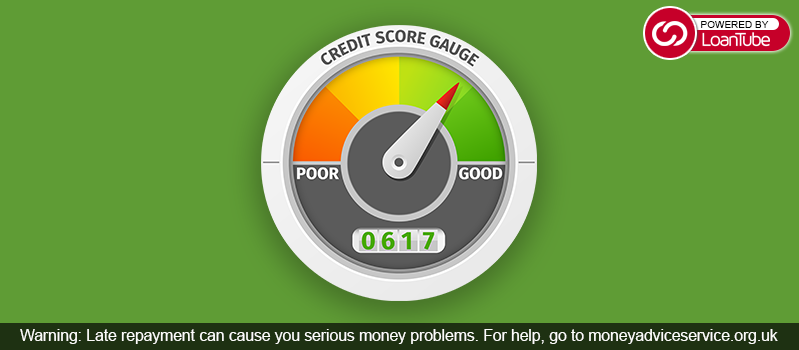

A credit score is usually a three-digit number that lenders and brokers use to decide whether you are eligible to get a debt, a credit card or some other line of credit, and the interest rate you will be charged for the credit.

There are also different types of credit score that exist, but your FICO credit score is the most commonly used. That score is between 300 and 850 and represents your relative level of trustworthiness for financial concerns.

Every individual has their own credit score. If you apply for a loan, and you seem a bit risky to the lender, the less likely you will get credit. Also, even if you are approved, the loan will cost you more. In other words, you have to pay more to borrow the credit.

All these forecasts that a credit rating is a crucial aspect to get a loan but certainly not the only.

However, it’s possible to improve your FICO score by taking out instalment loans. Unlike short-term loans, this loan is where you borrow a specific amount of money and repay it in a series of regular payments, or portions. Most of these loans require making payments on a monthly schedule. Vehicle loans, student loans, homeowner loan and personal loans are all types of high cost, short-term credit. Plus, your regular loan will come with a lower interest rate than a relative credit card.

Further, the credit will enhance your credit scores. The increase won’t be instant, it will take time, but eventually, it will help in improving your credit rating.

How can instalment loans affect your credit score?

These loans can help you improve your scores if:

• You repay your debt on time: These loans can help build credit if you are consistently repaying your credit and the lender is reporting your activity to one or more of the credit bureaus. This is important because the credit reports maintained at the national credit bureaus (Experian, Equifax, and TransUnion) retains your history of obtaining money and refunding debts. Each loan revealed on your credit report inflates your credit history. The significant impact on credit scores is payment history, and late payments can seriously damage your score.

• Enhance your credit mix: The number and type of loan that arises on your credit report build a credit scoring criteria—the analytical algorithms that extract the contents of your account reports into three-digit scores- commonly called credit score. “Credit Mix”, determines 10 per cent of your score and refers to the different kinds of debt you owe- credit card debt, personal loan debt, student debt, etc. The more distinct your credit mix- the better your credit grade stands.

If you have a lot of debt, taking a short-term loan to pay some of it off would also help increase your credit mix, which could help improve your credit.

• Drops credit utilization: Certainly, if you get an unsecured loan to pay credit cards or any other bill, your score may improve. Moving credit card liability on a loan decreases your credit utilization ratio. It plays a large factor in your credit and can instantly reduce your overall utilization.

How these loans operate double-time?

The credit profits of these loans are usually high. They help to make steady score changes over time. If the borrower has credit cards with a great level of credit utilization, a personal loan helps you pay off your credit card claims and could even boost your credit scores significantly at the same time.

Should you get an unsecured personal loan to build credit?

It’s usually stupid to take a loan rigidly to improve credit, but there’s always an exception. Some loans exist to build your credits. When you have no credit or weak credit, these instalment loans for bad credits can help you build your credit profile. Want to know how?

Paying the credit on time builds your credit history, and you hold an emergency fund by the time you’re done with repayments.

Paying on time raises your credit history, and you have a contingency fund at the same time. But failing to pay on time hurts your scores, and borrowing too much could strain your budget and lead to blown payments.

Final Word

Having said- it’s true that as you pay your debt, your score should improve, slowly and gradually. It’s also a fact that a lower loan balance compared to the original loan amount- is good for your credit score. However, keep in mind, that it can take time to be considerably lower than the original loan amount. This is because most of these loans experience balance decline much more slowly because they can amortize over many years or decades. Still, by making regular payments each month, you will further ensure that your credit scores are as high as they can be.