“FINANCIAL PLANNING is about more than just good advice or investment returns. It’s about providing GUIDANCE THAT YOU CAN TRUST”

DAVE RAMSEY

Imagine if what you know now, you knew way back in high school. How much cleared off would you be? When we were in high schools, we didn’t learn much about money, budgeting, or investing.

Unfortunately, Personal Finance has also not yet become a required subject in high school or college, so you might be slightly clueless about how to manage your money when you’re out in the present world for the first time.

To help you get started, the 786 Loans team has collated an article that delves into six of the most important things to learn about money and how to live a healthy and wealthy life.

#1. Learn Self-Control to Take Control of Your Own Financial Future

You’re fortunate if your parents taught you the skill of discipline when you were a child. If not, keep in mind that the sooner you learn the subtle art of holding gratification, the sooner you’ll find it easy to keep your finances under check. If you make a practice of settling all your purchases on credit, despite whether you can pay your bill at the end of the month, you might still be paying for those items in 10 years.

If you don’t learn to handle your own money, other people will find ways to confound it for you. Some of these people may be ill-intentioned, like corrupt financial executives. Others may be well-meaning, but may not know what they’re doing.

Instead of relying on others for help, take charge and read a few basic writings on personal finance. Once you’re fortified with personal finance knowledge, don’t let anyone grab you off guard – whether it’s a significant other that gradually syphons your bank account or friends who want you to go out and spend tonnes of pounds with them. Recognising how money works is the first step toward making your money work for you.

#2. Know Where Your Money Goes

Once you’ve run through a few personal finance books, you’ll notice how important it is to make sure your expenses aren’t outpacing your income. The best way to do this is by budgeting. Once you see how your expenses add up over the month, you’ll realize that making small, flexible changes can have a big impact on your financial condition. In addition, keeping your recurring monthly expenses as low as possible will also save you big bucks over time.

#3. Start Saving For Retirement Now

If your child is moving out, they likely have some earned income. That means they can start adding to an individual retirement account, and you need to prepare them for the retirement well in advance. Because of the way compound interest works, the earlier a person start saving, the less principal they’ll have to invest to end up with the amount you need to retire and the sooner you’ll be able to call working an “option” rather than a “necessity.”

Company-sponsored retirement plans are an expressly great choice because you get to put in pre-tax pounds and the benefaction limits tend to be high. Also, organisations will often match part of your contribution, which is like receiving free money.

#4. Get a Grip on Your Taxes

It’s important to learn how income taxes work, even before you get your first paycheck. When a company offers you an opening salary, you need to know, how to calculate whether the salary will give you enough money after taxes to meet your financial goals and obligations. Luckily, there are plenty of online websites that have taken the ruthless work out of determining your salary taxes. These websites will show you your gross pay, and the salary that you’ll be left with as take-home pay.

#5. Guard Your Health and Wealth

If paying monthly health insurance premiums seems impossible, what will you do if you have to go to the accident room, where a single visit for a minor injury like a torn bone can cost thousands of pounds? If you’re uninsured, don’t wait another day to appeal for health insurance; it’s easier than you think to turn up in a car accident or trip down your hallway stairs. Also, median household disposable income in the UK was £28,400 in the financial year ending (FYE) 2018, and with this income stats, you can try to save money by getting quotes from different insurance providers to find the cheapest rates. Additionally, by taking small steps, like eating fruits and vegetables, exercising, not smoking, and even driving carefully, you’ll thank yourself down the lane when you aren’t paying extravagant medical bills.

If you want to make sure that your hard-earned money doesn’t vanish, you’ll need to take steps to protect it. If you want help managing your money, find a financial executive to provide an unbiased opinion that’s in your best interest. You’ll also want to protect your money from taxes, which is easy to do with a retirement account.

#6. Credit Cards and Drawbacks

Credit cards can help a person build credit, and that’s important when you are starting out. Some credit cards offer nice benefits, such as cash back on purchases or travel rewards miles that seem very beneficial. Young people must know that credit card balances should be paid off in full each month whenever possible. Also, parents should show their child that credit card interest rates can be extravagant and that high balances can lead to a debt trap from which they may never escape.

By the time people realize the bills, they already reach around thousands of pounds in credit card bill. With an average weekly household expenditure of £572.60 in the UK in the financial year ending 2018. It becomes more important to learn that it’s smarter to avoid debt.

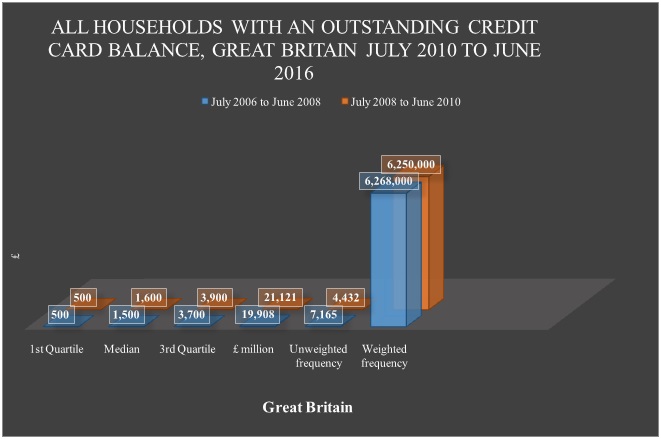

The image will help you in understanding the level to which the credit debt can reach up for a household.

OUTLINE THE PAIN OF DEBT

Arguably, the most vital lesson to learn is the concept and the drawbacks of a debt. Taking time in learning the basics of borrowing and understanding how expenses can continue to increase if the debt is not paid off is very important. Viewing calculations with interest rates for credit cards, auto loans, short-term loans, personal loans, and mortgages gives an understanding of debt-to-income ratios, and what that means in the context of their financial well-being. Also, it supports you in discerning the basic models of the credit scoring system and the significance of credits like personal loans for bad credits, short-term loan for bad credit, or any other bad credit loan.

The Bottom Line

Remember, you don’t need any fancy degrees or special education to become a master at controlling and managing your finances. If you use these six financial practices for your life, you can be affluent.